Semilla Climate Capital is pleased to announce an investment in Solidec’s oversubscribed $2M pre-seed round.

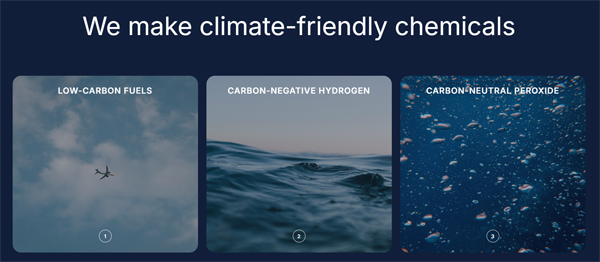

Solidec’s breakthrough approach to chemical manufacturing replaces centralized infrastructure with modular, efficient on-site production using only air, water, and electricity. Solidec’s platform is powered by modular reactors capable of producing many widely used chemicals, including hydrogen peroxide, formic acid, acetic acid, and ethylene without any post-processing steps required. Solidec is initially focused on the production of hydrogen peroxide, a critical chemical used across industries from semiconductor fabrication and critical metal mining to wastewater treatment.

Solidec’s platform technology is poised to disrupt the multi-billion-dollar commodity and chemical industries. The company has already secured early commercial customers, highlighting the demand for breakthrough technologies that rewrite the rules of chemical manufacturing. With these funds secured, Solidec will accelerate its go-to-market with a focus on pilot deployments and scaling its technology to meet customer-specific needs in multiple industries.

“Traditionally, hydrogen peroxide is produced in centralized, energy-intensive facilities using carbon-intensive inputs, then transported long distances, resulting in a significant carbon footprint,” said Ryan DuChanois, Co-Founder and CEO of Solidec. “Solidec’s modular reactor produces clean chemicals like hydrogen peroxide on-site, in fewer steps, and with less energy, slashing emissions, supply-chain risk, and cost. We’re eager to deliver these capabilities to customers across the globe.”

The chemical and petrochemical industries account for about 40 percent of industrial carbon emissions in the United States. Chemical separations alone – the post-processing steps Solidec eliminates – are responsible for 15 percent of global energy consumption. Solidec’s technology is forging a path to emission-free molecules for the global chemical manufacturing industry, and creating opportunities to accelerate innovation in multiple other industries.

Solidec spun out from Professor Haotian Wang’s lab at Rice University in 2024 and is based in Houston, Texas. The company is a recipient of the Activate Fellowship, a graduate of the Chevron Catalyst Program, and a member of Greentown Labs Houston.